VANCOUVER, BC / ACCESSWIRE / January 29, 2024 / (TSX.V:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to provide a 2023 year-end update on its royalty portfolio and forecast for 2024.

Paddy Nicol, Orogen's CEO commented, "Orogen saw continued strong operating performance from First Majestic Silver Corp.'s ("First Majestic") Ermitaño mine and several significant advancements were made on AngloGold Ashanti NA's ("AngloGold") Expanded Silicon project. At the Ermitaño mine, solid production and record metal recoveries were achieved in Q4-2023, with robust production guidance for 2024. At the Expanded Silicon project, AngloGold continues to develop the Silicon deposit and the Merlin Exploration Target A with over 719 drill holes completed as of Q3-2023. An initial Mineral Resource declaration at Merlin is expected in early 2024. Orogen's other royalty assets also saw advancement with drilling, exploration, and permitting on various projects including the MPD South and Onjo projects in British Columbia, and the Cuprite project in Nevada."

2023 Highlights

- The Ermitaño gold-silver mine in Mexico, where the Company holds a 2% net smelter return ("NSR") royalty, produced 28,056 ounces of gold and 582,484 ounces of silver in 4Q-2023, representing a 1% decrease in gold ounces and a 67% increase in silver ounces from 3Q-2023. Gold and silver recoveries achieved a record 96% and 73%, respectively.

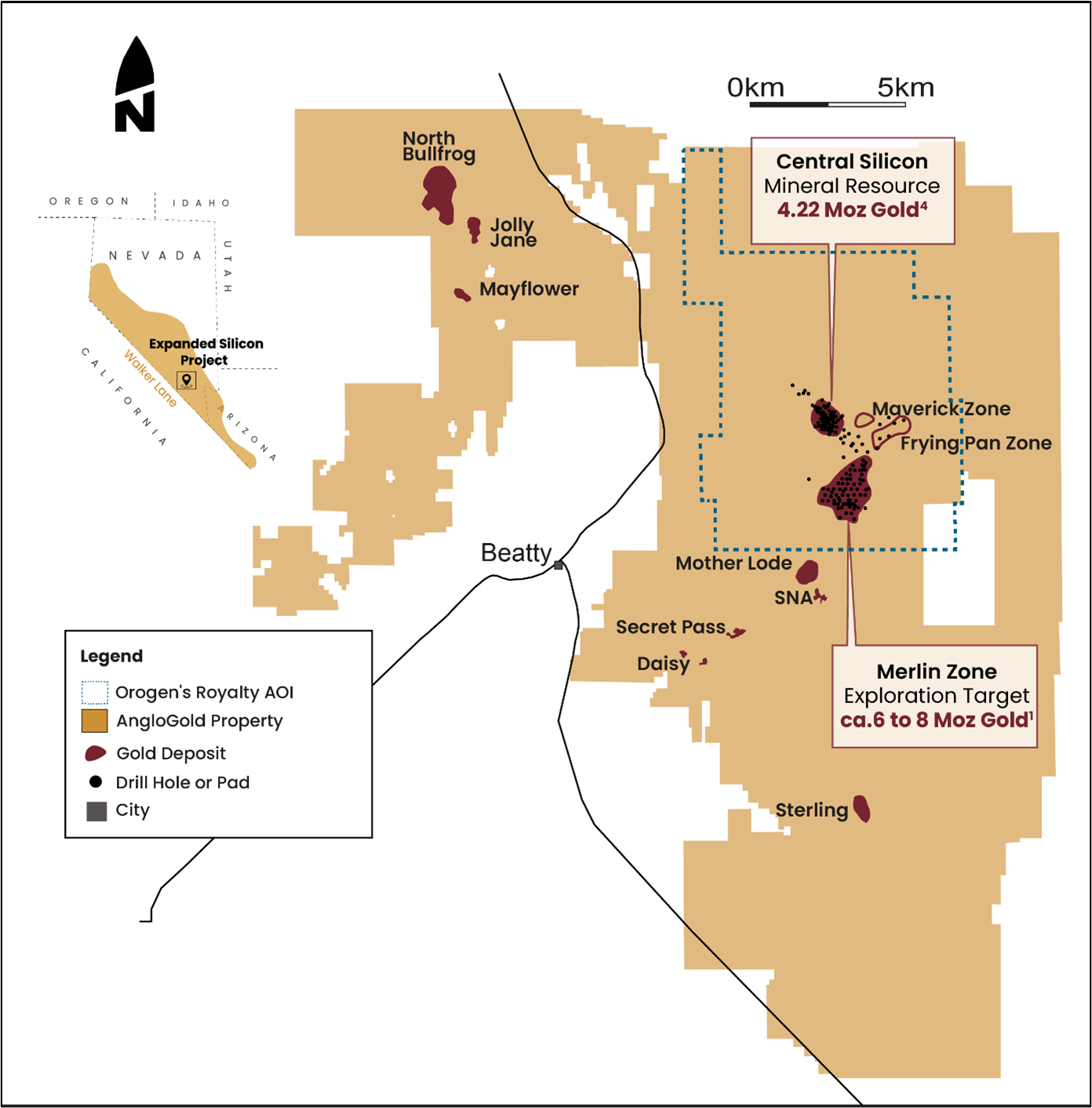

- The Expanded Silicon project in Nevada, where the Company holds a 1% NSR royalty, ended the year with a 4.22 million ounce gold resource (3.22 million ounces indicated and 800,000 ounces inferred) at the Silicon Deposit, and a 6-8 million ounces gold Exploration Target A at the Merlin Area. Several key catalysts are expected at the Expanded Silicon project over the short term.

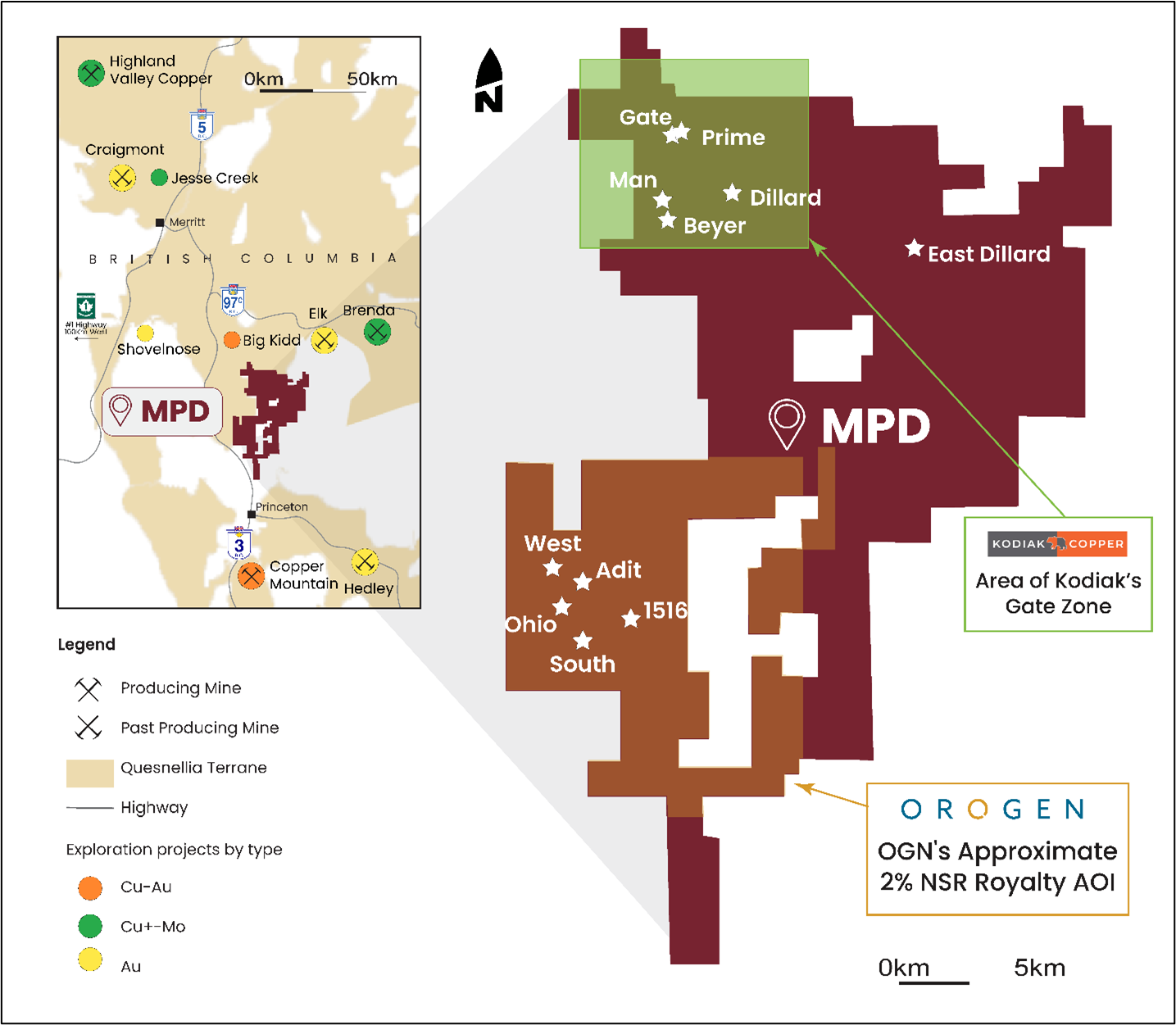

- Significant progress on Kodiak Copper Corp.'s ("Kodiak") (TSX.V:KDK) MPD copper-gold project in British Columbia, where the Company holds a 2% NSR royalty on the MPD South lands. Using a Cadia-Ridgeway style exploration model as a key tool for project advancement, the West Zone has been expanded to 650 metres along strike, 350 metres width and over 960 metres in depth. At the South Zone, drilling to connect the historically drilled Mid Zone yielded a near continuously mineralized drill intercept of 1,053 metres.

- Strikepoint Gold Inc. ("Strikepoint") (TSX.V:SKP) recently announced a 5,000 metre drill program on the Cuprite gold project in Nevada, where the Company holds a 1.5% NSR royalty, to test a series of priority targets identified from field work and geophysics completed in 2023.

Royalty Portfolio Update

Ermitaño - Epithermal Gold-Silver Mine, Sonora, Mexico

Orogen holds a 2% NSR royalty on First Majestic's Ermitaño Mine with Measured and Indicated resources of 369,000 ounces of gold and 5.8 million ounces of silver, and Inferred resources of 269,000 ounces of gold and 7.7 million ounces of silver as of Dec 31, 20221,2.

The Ermitaño mine is operated within First Majestic's Santa Elena processing and mill complex that receives ore from both the Ermitaño Mine and the Santa Elena Mine. Forecasted mine production guidance for 2024 is 81,000 to 90,000 ounces gold and 1.1 to 1.2 million ounces silver, with over 90% of the production from the Ermitaño mine.

Approximately 22,000 metres of drilling is planned in 2024 to increase the confidence of the resources and to test secondary veins at Ermitaño, and an estimated 59,000 metres of exploration drilling within a five-kilometres radius of the Santa Elena and Ermitaño mine complex. The 2023 Mineral Reserve and Resource update is expected towards the end of Q1-2024.

Expanded Silicon Project - Epithermal Gold Project, Nevada, USA

Orogen holds a 1% NSR royalty on the Expanded Silicon project operated by AngloGold. In February 2023, AngloGold announced a 4.22 million ounces gold resource consisting of 3.22 million ounces indicated and 800,000 ounces inferred at the Silicon Deposit4 and in August, a 6 to 8 million ounce gold Exploration TargetA at Merlin, with an estimated grade-tonnage range of 230 to 250 million tonnes grading 0.8 to 1.0 grams per tonne ("g/t") gold. Selected drill holes disclosed by AngloGold from Merlin drilling include5,6:

- MER-23-0147-RD 285 metres of 3.27 g/t gold

- MER-23-0112-RD 108 metres of 7.94 g/t gold

- MDT-0021 214.8 metres of 2.46 g/t gold

Several studies are underway at the Expanded Silicon project including a first-ever resource estimation at Merlin, open pit and underground mining approaches for Merlin including high grade domains that may warrant large-scale milling, project staging options for potentially faster mine start-up, and a Concept Study that integrates the synergies of the Silicon Deposit and Merlin Exploration TargetA. A Pre-Feasibility study is also expected to start this year.

MPD South (Axe) - Copper- Gold Porphyry, British Columbia, Canada

Orogen holds a 2% NSR royalty subject to a 0.5% NSR royalty buydown on Kodiak's MPD South property (formerly Axe; Figure 2). MPD South is located within the greater MPD project and approximately 10 kilometres south on the same structural trend as Kodiak's Gate Zone discovery.

Over 18,500 metres of drilling in 33 holes across the whole MPD property7 were completed in 2023, with at least 14 drill holes on Orogen's royalty ground, including eight drill holes (4,489 metres) from the West zone8,9 and two holes (1,911 metres) from the South zone10. Results from drilling at the 1516 zone are pending.

Drilling at the West Zone increased the area of porphyry mineralization to an area of over 300 metres by 650 metres and up to 962 metres depths, with the discovery of a hydrothermal breccia zone with mineralized clasts at depth, indicating significant potential for growth.

- Axe 23-011 941 metres grading 0.21% copper and 0.16 g/t gold including 0.49% copper and 0.29 g/t gold over 254 metres

- Axe 23-001 533 metres grading 0.18% copper and 0.2 g/t gold including 0.28% copper and 0.28 g/t gold over 158 metres

- Axe 23-008 198 metres grading 0.33% copper and 0.18 g/t gold including 1.17% copper and 0.42 g/t gold over 39 metres

Drilling at the South zone returned extensive long intersections of copper mineralization linking the historic south zone and mid zones, indicating a larger mineralized system over two kilometres in length10.

- AXE23-014 intersected 1053 metres grading 0.17% copper and 0.05 g/t gold including 0.31% copper and 0.09 g/t gold over 234 metres

- AXE 23-012 intersected 813 metres grading 0.15% copper and 0.04 g/t gold including 0.24% copper and 0.07 g/t gold at 45 metres

Cuprite - Epithermal Gold Target, Nevada, USA

Orogen holds a 1.5% NSR royalty on the Cuprite project, subject to a 0.25% buydown owned by Strikepoint. Strikepoint completed a comprehensive field program at the Cuprite project, indicating several targets geologically similar to AngloGold's Expanded Silicon deposit11. Drill permits have been received with a planned 5,000 metre drilling program expected to start in late February12. Strikepoint also completed an extensive staking program at Cuprite project, approximately doubling the size of Orogen's royalty area of interest.

The undrilled Cuprite project was identified under the Nevada Alliance between Orogen and Altius Minerals Corporation in 2022 using similar analytical techniques that initially identified the Expanded Silicon project.

Onjo - Copper-Gold Porphyry, British Columbia, Canada

Orogen has a 2% NSR royalty on the Onjo copper-gold porphyry project owned by Pacific Ridge Exploration Ltd. ("Pacific Ridge"). In 2023, Pacific Ridge completed an induced polarization survey over the Chica and Gingla targets on the Onjo property13. Results are pending.

Equity Based Compensation Grant

The Board of Directors have authorized a grant of 707,000 Restricted Share Units ("RSUs"), 132,000 Deferred Share Units ("DSUs") and 1,864,000 Stock Options to directors, officers, employees, and consultants pursuant to the Company's Omnibus Equity Incentive Compensation Plan that was approved by shareholders at the Company's Annual and Special General Meeting on October 25, 2023. These grants are a long-term incentive component of the Company's compensation plan.

The RSUs awarded will fully vest on the second anniversary of the date of grant. The DSUs awarded will vest 50% each on the third and fourth anniversaries of the grant date and will settle on the termination of service. The Stock Options have a life of five years, an exercise price of $0.70, and will vest over three years including 25% that will vest immediately followed by 25% on the first, second, and third anniversaries from the date of grant.

These equity-based compensation grants are subject to regulatory acceptance of the TSX Venture Exchange.

Qualified Person Statement

All new technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., VP. Exploration for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Certain technical disclosure in this release is a summary of previously released information and the Company is relying on the interpretation provided by the relevant referenced partner. Additional information can be found on the links in the footnotes or on SEDAR+ (www.sedarplus.ca).

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. and the Expanded Silicon Project (1.0% NSR royalty) in Nevada, U.S.A, being advanced by AngloGold Ashanti. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

- https://www.firstmajestic.com/_resources/presentation/corporate-presentation.pdf?v=0.235

- http://www.firstmajestic.com/investors/news-releases/first-majestic-reports-high-grade-exploration-results-at-san-dimas-santa-elena-and-jerritt-canyon

- https://www.firstmajestic.com/investors/news-releases/first-majestic-produces-66-million-ageq-oz-in-q4-2023-and-269-million-ageq-oz-in-2023-announces-2024-production-and-cost-guidance-and-announces-conference-call-details

- https://thevault.exchange/?get_group_doc=143/1677005072-YearEnd2022-Resultsreport.pdf

- https://thevault.exchange/?get_group_doc=143/1691123637-Interim2023MerlinExplorationTarget.pdf

- https://thevault.exchange/?get_group_doc=143/1700636741-AngloGoldNewGenGold2023SiliconPresentationNov2023webv1.pdf

- https://kodiakcoppercorp.com/news/news-releases/kodiaks-first-holes-at-south-zone-extend-copper-mineralization-to-mid-zone-and-to-depth-0.32-cueq-over-234-m-from-surface/

- https://kodiakcoppercorp.com/news/news-releases/kodiaks-west-zone-drilling-intersects-0.51-cueq-over-158-m-within-0.34-cueq-over-533-m-from-surface-and-discovers-new-high/

- https://kodiakcoppercorp.com/news/news-releases/kodiak-drills-significant-from-surface-copper-at-west-zone-0.58-cueq-over-254-m-within-0.27-cueq-over-941-m/

- https://kodiakcoppercorp.com/news/news-releases/kodiaks-first-holes-at-south-zone-extend-copper-mineralization-to-mid-zone-and-to-depth-0.32-cueq-over-234-m-from-surface/

- https://strikepointgold.com/strikepoint-cuprite-gold-project-phase-1-exploration-results-large-scale-soil-and-coincidental-geophysical-anomalies-identified/

- https://strikepointgold.com/strikepoint-announces-cuprite-gold-project-2024-exploration-program-drill-permits-in-hand-for-5000-meters-of-drilling/

- https://pacificridgeexploration.com/news-releases/geophysics-program-underway-at-chuchi-and-onjo-financing/

A. Cautionary Note: The ranges of tonnage and grade of the Exploration Target are conceptual in nature and could change as the proposed exploration activities are completed. There has been insufficient exploration of the relevant property or properties to estimate a Mineral Resource at this point in time. It is uncertain if further exploration will result in the estimation of a Mineral Resource and the Exploration Target therefore does not represent, and should not be construed to be, an estimate of a Mineral Resource or Mineral Reserve. Given the conceptual stage of the project, a number of risks, uncertainties and opportunities, are evident in the confidence of the known orebody and the potential for upside at Silicon, Merlin and in the surrounding area. The Merlin Exploration Target grade and tonnage ranges have been determined by a preliminary review of the location and weighted average grade of the mineralised intercepts. The geology of the deposit contains a significant number of faulted offsets, which require detailed geological modelling to fully define the extent and continuity of the mineralisation. A bulk density value of 2.4 t/m3 was used. No economic constraint has been applied to the deposit to determine the extent of what material may ultimately be extracted.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Orogen Royalties Inc.

View the original press release on accesswire.com